Senate Bill 1539 expands the clean room transaction privilege tax (TPT) deduction and use tax exemption to include any clean room used for manufacturing, processing, fabrication or research and development, rather than only clean rooms used for manufacturing, processing, fabrication or research and development of semiconductor products. The bill received a “do pass” recommendation in the Senate Finance Committee on February 17, 2025.

Arizona’s Bioscience Industry is one of the Top Emerging Life Science Clusters in the United States.

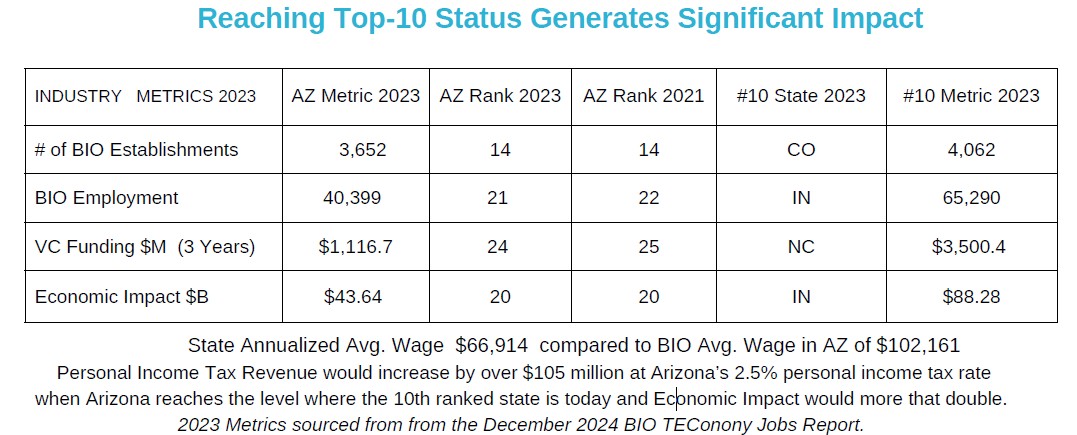

Arizona’s bioscience industry employed 40,399 in 2023 across 3,652 state business establishments, representing a rapid 24.6 percent increase in employment since 2019 and placing the state among the leaders in employment growth. The average wage in the bioscience industry was $102,161—53 percent higher than the state’s private sector average. Academic R&D expenditures in bioscience fields reached a new height of $683.3 million in 2022. NIH funding for Arizona totaled $366.5 million in 2023 following steady annual growth since 2019. Arizona’s bioscience companies attracted strong venture capital investment, with $281.8 million invested in 2023. Arizona stands out in patent activity in bioscience-related technology areas—its 3,387 patent awards from 2019 through 2023 places the state in the second quintile among all states. AZ-BIO2024 – state profile

- Arizona ranks #2 in the nation for Life Sciences Job Growth based on the 10 year average (2012-2022) calculated by the Kem C. Gardner Policy Institute, part of the David Eccles School of Business at the University of Utah. Only Massachusetts ranked higher. (Report)

- Arizona’s Health Innovation Ecosystem generated $43.64 billion in Economic Impact in 2023 up from $38.54 billion in 2021 reflecting growth of over 13% in 2 years. Growth in economic impact means brings benefits for all Arizonans. It means more activity in the community, it generates more tax dollars. This provides more money for education, for roads, for public safety, and more. And, when those dollars are circulating in our community, they multiply.

Room to Grow

Arizona’s growth is impressive. With over 6 million square feet of life science infrastructure under development, we have more room to grow as we work to achieve our goal to double the economic impact by 2033 and reach Top-10 Status.

Examples of State Clean Room Policies and Total Effective Business Tax Rates (TEBTR/FY22)

| State | TEBTR* | Semiconductor | Other Industries |

| AZ | 4.1% | Yes | Proposed in SB1539 |

| CA | 5.1% | Yes | Yes |

| CO | 5.0% | Yes | Yes |

| CT | 4.5% | Yes | All Industries |

| ID | 4.9% | Yes | All industries |

| IN | 4.1% | Bio Pharmaceuticals | |

| MA | 4.0% | Life Sciences | |

| NC | 3.6% | Yes | Physical, Engineering, Life Sciences |

| TX | 5.4% | Yes | pharmaceutical biotechnology |